Reverse Mortgage Loans by UrbanPointe Lending of Las - Truths

One Reverse Mortgage NMLS#2052 - An Overview

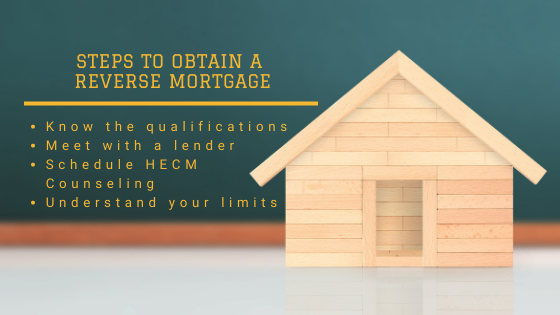

What are reverse home loans? A reverse home mortgage, or Home Equity Conversion Home Loan (HECM), is a type of home mortgage available to property owners 62 or older who have significant equity (typically a minimum of 50%) in their home. Another Point of View can benefit individuals who require extra money circulation for other costs, as the value of their home's equity can be converted to cash, eliminating regular monthly mortgage payments.

Reverse Mortgages and Long-Term Care - A Place for Mom

Rick RRodriguez - Branch Sales Manager, CRMP - Certified Reverse Mortgage Professional

This is called a "reverse" home loan, due to the fact that in contrast to a conventional mortgage, the lending institution makes the payments to the borrower. Reverse home loan fast view Readily available to property owners 62 and older One-time FHA MI fee of 2% of the house's value Obtain as much as 80% of the home's value Customer must have enough equity to certify Used for primary house just No prepayment charge Your Customized Reverse Home Mortgage Quote Start your free quote from Mann Home loan Just how much cash can you borrow? The quantity of money a customer can survive a reverse mortgage is reliant on their age, the current reverse mortgage/HECM rate of interest, their existing home mortgage balance if they have one, and what an independent appraiser figures out as their house's present worth.

House equity is the difference in between what a property owner owes in a mortgage compared to what their house deserves. If a house deserves $300,000 and they owe $150,000 on their home mortgage, they would have $150,000 in home equity. Key obligations of house owners with a reverse mortgage Homeowners with a reverse mortgage have 3 primary duties: The debtor should in the house as a primary residence The debtor must maintain the home in great condition Taxes, insurance and other house ownership expense must be paid Pros of a reverse home mortgage It may be an excellent option for homeowners with limited earnings and a great deal of equity in their home.

Reverse Mortgages Can Be Fun For Everyone

The reverse home loan could likewise be utilized to settle their initial mortgage so they will no longer have to make regular monthly payments. Cons of a reverse home loan The primary balance will increase over time as the interest and FHA MI fees accumulate. Understand that if a customer isn't utilizing the house as a primary house, it may lead to the loan needing to be paid back earlier.